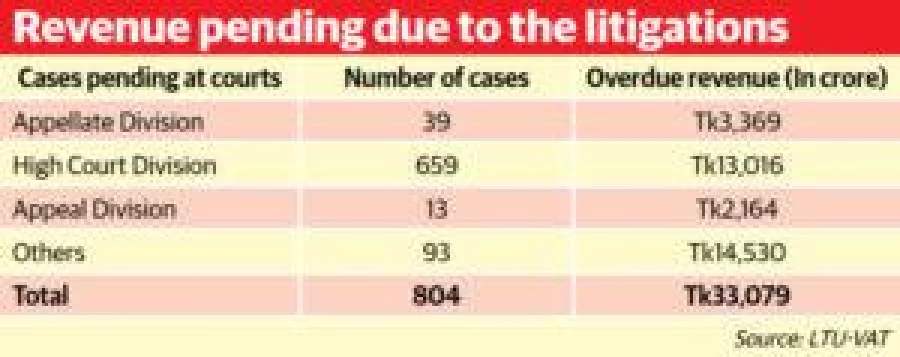

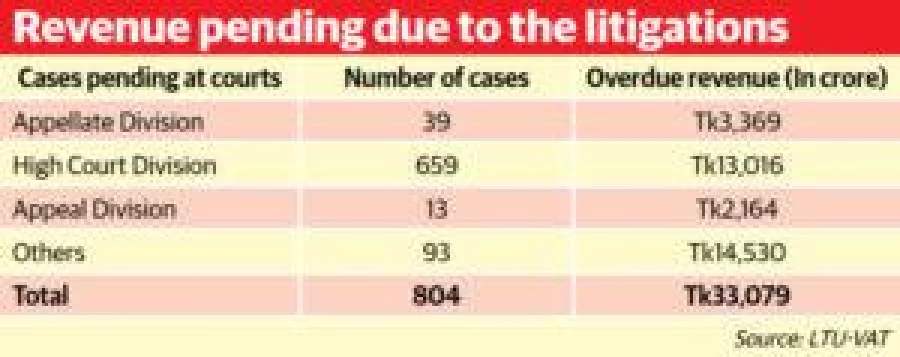

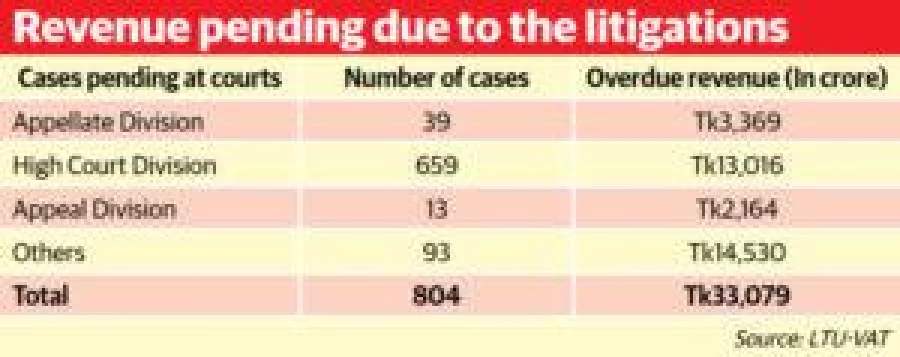

Out of the total cases, 39 cases involving Tk3,369crore are pending with the Appellate Tribunal while Tk13,106 crore remain pending with 659 cases with the High Court Division, 13 cases involving Tk2,164 crore are pending with the Appellate Division of the Supreme Court.

Ninety three cases involving Tk14,530 are pending with other courts.

The LTU-VAT has mobilised Tk3,500 crore by settling only 110 cases in the last 13 years since its establishment, Munshi told the Dhaka Tribune.

Currently, 170 companies are registered with LTU-VAT. Of them, 157 are conducting commercial activities.

Presenting overall scenario of LTU-VAT, NBR Commissioner Matiar Rahman said they are assigned to collect Tk40,632.89 crore VAT in the ongoing fiscal year 2016-17.

The office has collected around Tk26,388 crore as of March, the data showed.

British American Tobacco Bangladesh President Golam Mainuddin urged the NBR to settle the disputes through Alternative Dispute Resolution to avoid complexities with regular court cases.

Prime Minister and Awami League President Sheikh Hasina’s private sector affairs adviser Salman F Rahman was present as the chief guest while NBR Chairman Md Nojibur Rahman was on the chair.

Salman F Rahman said: “I, on behalf of the business community, welcome the new VAT law, scheduled to be implemented from July 1. But I want to request the NBR to make sure that the revenue officials show a flexible attitude in the first 3-4 months of implementation of the law and consider it as transitional period.”

Responding to the call, NBR chairman assured that the new VAT law will be hassle-free.

“If there is any problem with the new law, we will solve it as soon as possible,” he said.

The programme was also attended by NBR members Jahangir Hossain (VAT policy), Parvez Iqbal (Tax Policy) and Lutfor Rahman (Customs Policy).

Earlier, the NBR took an initiative to boost revenue

collection through swift settlement of thousands of revenue-related cases pending with different courts of the country for years, UNB reported.

Wishing anonymity, a senior NBR official said: “This is not a negligible amount and it increases day by day as cases pile up.”

At a function last year, Attorney General Mahbubey Alam asked the NBR to strengthen the communication between the NBR and his office for quick resolution of the pending cases.

An NBR official at that time said: “From the NBR we requested the AG office to give special attention to the NBR related cases especially the revenue related cases which have been piled up for a long time.”

He said the NBR chairman Md Nojibur Rahman also asked the respective officials to expedite the Alternative Dispute Resolution taking advices from the AG office for settling down the pending cases.

Out of the total cases, 39 cases involving Tk3,369crore are pending with the Appellate Tribunal while Tk13,106 crore remain pending with 659 cases with the High Court Division, 13 cases involving Tk2,164 crore are pending with the Appellate Division of the Supreme Court.

Ninety three cases involving Tk14,530 are pending with other courts.

The LTU-VAT has mobilised Tk3,500 crore by settling only 110 cases in the last 13 years since its establishment, Munshi told the Dhaka Tribune.

Currently, 170 companies are registered with LTU-VAT. Of them, 157 are conducting commercial activities.

Presenting overall scenario of LTU-VAT, NBR Commissioner Matiar Rahman said they are assigned to collect Tk40,632.89 crore VAT in the ongoing fiscal year 2016-17.

The office has collected around Tk26,388 crore as of March, the data showed.

British American Tobacco Bangladesh President Golam Mainuddin urged the NBR to settle the disputes through Alternative Dispute Resolution to avoid complexities with regular court cases.

Prime Minister and Awami League President Sheikh Hasina’s private sector affairs adviser Salman F Rahman was present as the chief guest while NBR Chairman Md Nojibur Rahman was on the chair.

Salman F Rahman said: “I, on behalf of the business community, welcome the new VAT law, scheduled to be implemented from July 1. But I want to request the NBR to make sure that the revenue officials show a flexible attitude in the first 3-4 months of implementation of the law and consider it as transitional period.”

Responding to the call, NBR chairman assured that the new VAT law will be hassle-free.

“If there is any problem with the new law, we will solve it as soon as possible,” he said.

The programme was also attended by NBR members Jahangir Hossain (VAT policy), Parvez Iqbal (Tax Policy) and Lutfor Rahman (Customs Policy).

Earlier, the NBR took an initiative to boost revenue

collection through swift settlement of thousands of revenue-related cases pending with different courts of the country for years, UNB reported.

Wishing anonymity, a senior NBR official said: “This is not a negligible amount and it increases day by day as cases pile up.”

At a function last year, Attorney General Mahbubey Alam asked the NBR to strengthen the communication between the NBR and his office for quick resolution of the pending cases.

An NBR official at that time said: “From the NBR we requested the AG office to give special attention to the NBR related cases especially the revenue related cases which have been piled up for a long time.”

He said the NBR chairman Md Nojibur Rahman also asked the respective officials to expedite the Alternative Dispute Resolution taking advices from the AG office for settling down the pending cases.An amount of Tk33,079 crore value-added tax that has been overdue from big businesses under the Large Taxpayers Unit cannot be realised yet as 804 cases remain pending in court for years.

Assistant Commissioner of Tax (ACT) Badruzzaman Munshi disclosed the facts while presenting a summary on VAT-related cases of the LTU-VAT at a dialogue in Dhaka on Monday.

Of the total overdue amount, a sum of Tk16,275.72 crore remains stuck due to 30 cases lodged by 30 companies, he said. Out of the total cases, 39 cases involving Tk3,369crore are pending with the Appellate Tribunal while Tk13,106 crore remain pending with 659 cases with the High Court Division, 13 cases involving Tk2,164 crore are pending with the Appellate Division of the Supreme Court.

Ninety three cases involving Tk14,530 are pending with other courts.

The LTU-VAT has mobilised Tk3,500 crore by settling only 110 cases in the last 13 years since its establishment, Munshi told the Dhaka Tribune.

Currently, 170 companies are registered with LTU-VAT. Of them, 157 are conducting commercial activities.

Presenting overall scenario of LTU-VAT, NBR Commissioner Matiar Rahman said they are assigned to collect Tk40,632.89 crore VAT in the ongoing fiscal year 2016-17.

The office has collected around Tk26,388 crore as of March, the data showed.

British American Tobacco Bangladesh President Golam Mainuddin urged the NBR to settle the disputes through Alternative Dispute Resolution to avoid complexities with regular court cases.

Prime Minister and Awami League President Sheikh Hasina’s private sector affairs adviser Salman F Rahman was present as the chief guest while NBR Chairman Md Nojibur Rahman was on the chair.

Salman F Rahman said: “I, on behalf of the business community, welcome the new VAT law, scheduled to be implemented from July 1. But I want to request the NBR to make sure that the revenue officials show a flexible attitude in the first 3-4 months of implementation of the law and consider it as transitional period.”

Responding to the call, NBR chairman assured that the new VAT law will be hassle-free.

“If there is any problem with the new law, we will solve it as soon as possible,” he said.

The programme was also attended by NBR members Jahangir Hossain (VAT policy), Parvez Iqbal (Tax Policy) and Lutfor Rahman (Customs Policy).

Earlier, the NBR took an initiative to boost revenue

collection through swift settlement of thousands of revenue-related cases pending with different courts of the country for years, UNB reported.

Wishing anonymity, a senior NBR official said: “This is not a negligible amount and it increases day by day as cases pile up.”

At a function last year, Attorney General Mahbubey Alam asked the NBR to strengthen the communication between the NBR and his office for quick resolution of the pending cases.

An NBR official at that time said: “From the NBR we requested the AG office to give special attention to the NBR related cases especially the revenue related cases which have been piled up for a long time.”

He said the NBR chairman Md Nojibur Rahman also asked the respective officials to expedite the Alternative Dispute Resolution taking advices from the AG office for settling down the pending cases.

Out of the total cases, 39 cases involving Tk3,369crore are pending with the Appellate Tribunal while Tk13,106 crore remain pending with 659 cases with the High Court Division, 13 cases involving Tk2,164 crore are pending with the Appellate Division of the Supreme Court.

Ninety three cases involving Tk14,530 are pending with other courts.

The LTU-VAT has mobilised Tk3,500 crore by settling only 110 cases in the last 13 years since its establishment, Munshi told the Dhaka Tribune.

Currently, 170 companies are registered with LTU-VAT. Of them, 157 are conducting commercial activities.

Presenting overall scenario of LTU-VAT, NBR Commissioner Matiar Rahman said they are assigned to collect Tk40,632.89 crore VAT in the ongoing fiscal year 2016-17.

The office has collected around Tk26,388 crore as of March, the data showed.

British American Tobacco Bangladesh President Golam Mainuddin urged the NBR to settle the disputes through Alternative Dispute Resolution to avoid complexities with regular court cases.

Prime Minister and Awami League President Sheikh Hasina’s private sector affairs adviser Salman F Rahman was present as the chief guest while NBR Chairman Md Nojibur Rahman was on the chair.

Salman F Rahman said: “I, on behalf of the business community, welcome the new VAT law, scheduled to be implemented from July 1. But I want to request the NBR to make sure that the revenue officials show a flexible attitude in the first 3-4 months of implementation of the law and consider it as transitional period.”

Responding to the call, NBR chairman assured that the new VAT law will be hassle-free.

“If there is any problem with the new law, we will solve it as soon as possible,” he said.

The programme was also attended by NBR members Jahangir Hossain (VAT policy), Parvez Iqbal (Tax Policy) and Lutfor Rahman (Customs Policy).

Earlier, the NBR took an initiative to boost revenue

collection through swift settlement of thousands of revenue-related cases pending with different courts of the country for years, UNB reported.

Wishing anonymity, a senior NBR official said: “This is not a negligible amount and it increases day by day as cases pile up.”

At a function last year, Attorney General Mahbubey Alam asked the NBR to strengthen the communication between the NBR and his office for quick resolution of the pending cases.

An NBR official at that time said: “From the NBR we requested the AG office to give special attention to the NBR related cases especially the revenue related cases which have been piled up for a long time.”

He said the NBR chairman Md Nojibur Rahman also asked the respective officials to expedite the Alternative Dispute Resolution taking advices from the AG office for settling down the pending cases.

Out of the total cases, 39 cases involving Tk3,369crore are pending with the Appellate Tribunal while Tk13,106 crore remain pending with 659 cases with the High Court Division, 13 cases involving Tk2,164 crore are pending with the Appellate Division of the Supreme Court.

Ninety three cases involving Tk14,530 are pending with other courts.

The LTU-VAT has mobilised Tk3,500 crore by settling only 110 cases in the last 13 years since its establishment, Munshi told the Dhaka Tribune.

Currently, 170 companies are registered with LTU-VAT. Of them, 157 are conducting commercial activities.

Presenting overall scenario of LTU-VAT, NBR Commissioner Matiar Rahman said they are assigned to collect Tk40,632.89 crore VAT in the ongoing fiscal year 2016-17.

The office has collected around Tk26,388 crore as of March, the data showed.

British American Tobacco Bangladesh President Golam Mainuddin urged the NBR to settle the disputes through Alternative Dispute Resolution to avoid complexities with regular court cases.

Prime Minister and Awami League President Sheikh Hasina’s private sector affairs adviser Salman F Rahman was present as the chief guest while NBR Chairman Md Nojibur Rahman was on the chair.

Salman F Rahman said: “I, on behalf of the business community, welcome the new VAT law, scheduled to be implemented from July 1. But I want to request the NBR to make sure that the revenue officials show a flexible attitude in the first 3-4 months of implementation of the law and consider it as transitional period.”

Responding to the call, NBR chairman assured that the new VAT law will be hassle-free.

“If there is any problem with the new law, we will solve it as soon as possible,” he said.

The programme was also attended by NBR members Jahangir Hossain (VAT policy), Parvez Iqbal (Tax Policy) and Lutfor Rahman (Customs Policy).

Earlier, the NBR took an initiative to boost revenue

collection through swift settlement of thousands of revenue-related cases pending with different courts of the country for years, UNB reported.

Wishing anonymity, a senior NBR official said: “This is not a negligible amount and it increases day by day as cases pile up.”

At a function last year, Attorney General Mahbubey Alam asked the NBR to strengthen the communication between the NBR and his office for quick resolution of the pending cases.

An NBR official at that time said: “From the NBR we requested the AG office to give special attention to the NBR related cases especially the revenue related cases which have been piled up for a long time.”

He said the NBR chairman Md Nojibur Rahman also asked the respective officials to expedite the Alternative Dispute Resolution taking advices from the AG office for settling down the pending cases.

Out of the total cases, 39 cases involving Tk3,369crore are pending with the Appellate Tribunal while Tk13,106 crore remain pending with 659 cases with the High Court Division, 13 cases involving Tk2,164 crore are pending with the Appellate Division of the Supreme Court.

Ninety three cases involving Tk14,530 are pending with other courts.

The LTU-VAT has mobilised Tk3,500 crore by settling only 110 cases in the last 13 years since its establishment, Munshi told the Dhaka Tribune.

Currently, 170 companies are registered with LTU-VAT. Of them, 157 are conducting commercial activities.

Presenting overall scenario of LTU-VAT, NBR Commissioner Matiar Rahman said they are assigned to collect Tk40,632.89 crore VAT in the ongoing fiscal year 2016-17.

The office has collected around Tk26,388 crore as of March, the data showed.

British American Tobacco Bangladesh President Golam Mainuddin urged the NBR to settle the disputes through Alternative Dispute Resolution to avoid complexities with regular court cases.

Prime Minister and Awami League President Sheikh Hasina’s private sector affairs adviser Salman F Rahman was present as the chief guest while NBR Chairman Md Nojibur Rahman was on the chair.

Salman F Rahman said: “I, on behalf of the business community, welcome the new VAT law, scheduled to be implemented from July 1. But I want to request the NBR to make sure that the revenue officials show a flexible attitude in the first 3-4 months of implementation of the law and consider it as transitional period.”

Responding to the call, NBR chairman assured that the new VAT law will be hassle-free.

“If there is any problem with the new law, we will solve it as soon as possible,” he said.

The programme was also attended by NBR members Jahangir Hossain (VAT policy), Parvez Iqbal (Tax Policy) and Lutfor Rahman (Customs Policy).

Earlier, the NBR took an initiative to boost revenue

collection through swift settlement of thousands of revenue-related cases pending with different courts of the country for years, UNB reported.

Wishing anonymity, a senior NBR official said: “This is not a negligible amount and it increases day by day as cases pile up.”

At a function last year, Attorney General Mahbubey Alam asked the NBR to strengthen the communication between the NBR and his office for quick resolution of the pending cases.

An NBR official at that time said: “From the NBR we requested the AG office to give special attention to the NBR related cases especially the revenue related cases which have been piled up for a long time.”

He said the NBR chairman Md Nojibur Rahman also asked the respective officials to expedite the Alternative Dispute Resolution taking advices from the AG office for settling down the pending cases.