The governmental policy support given to the private commercial banks facing a liquidity crunch was a mere temporary solution to the crisis, as those involved in the sector (owners and bankers) have to adopt a sustainable plan in order to avoid such problems in the future.

Economists, bankers, experts, and policymakers say the government has given all-out support to save the sector, and that now those concerned with the sector need to work for its revival by making the best use of government policies.

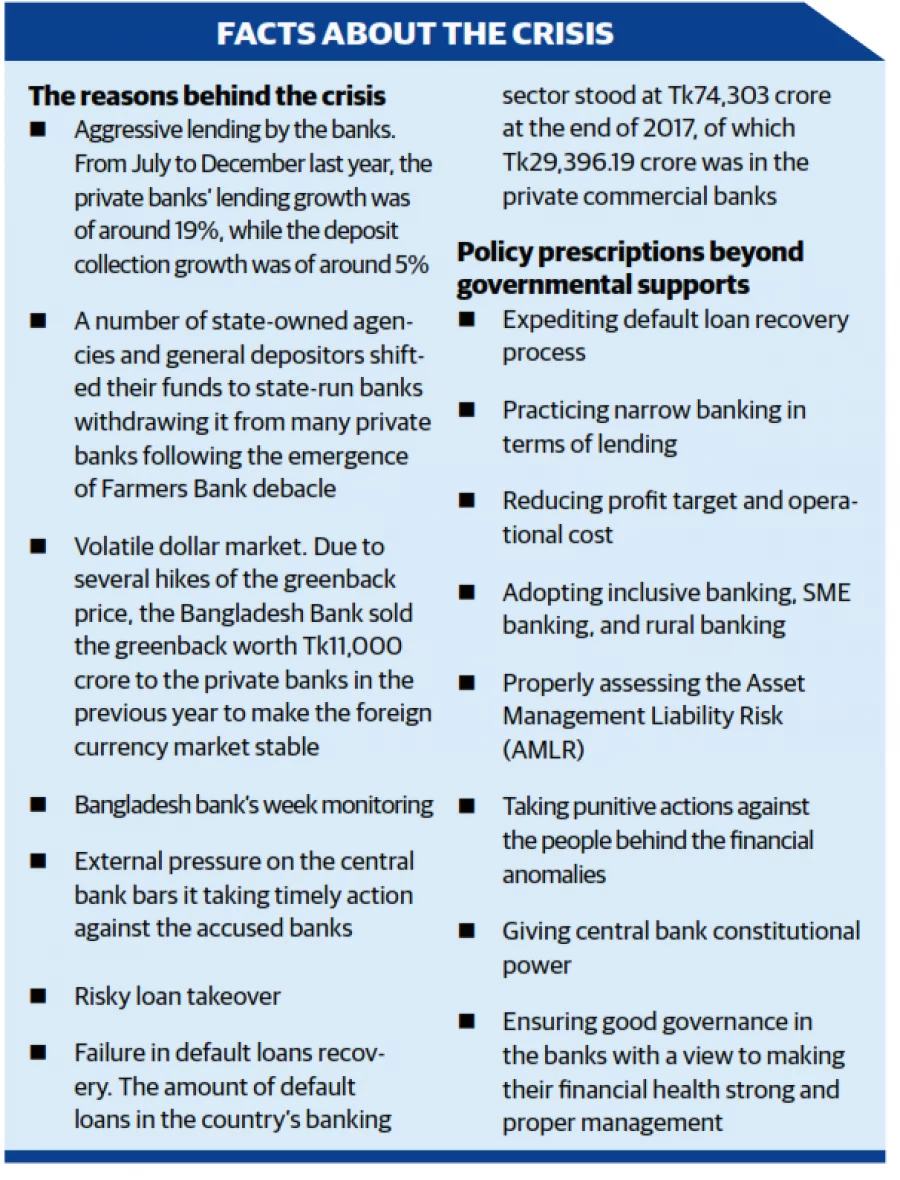

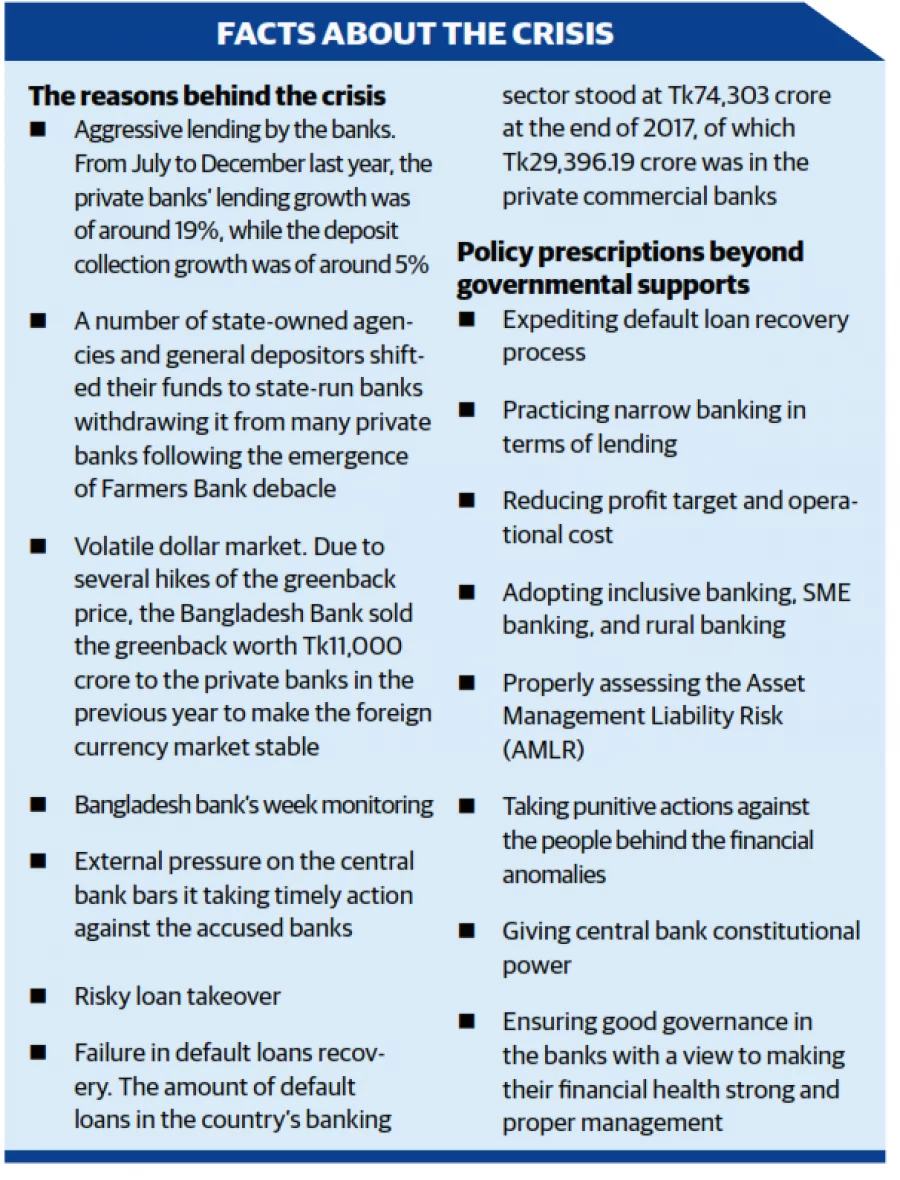

Private banks in Bangladesh have been facing a severe liquidity crisis since the beginning of this year, which is affecting the country’s businesses.

Due to the crisis, interest rates on bank loans went above 10%, affecting the country’s industrial growth by making it more difficult to take a loan.

Following the crisis, the central bank and the government have come up with a series of bailout policies to save private banks.

In one sense, the decisions would put public money at a greater risk

The policies include reducing the cash reserve requirement (CRR) by one percentage point to 5.5% from 6.5%, reducing the repo rate by 0.75% points to 6% from 6.75% aiming to make funds cheaper for all commercial banks, making deposits of 50% of the funds of state-owned agencies in private banks mandatory up from of 25%, and extending the deadline for adjusting the new advance-deposit ratio (ADR) to below 83.50% from the existing ceiling of 85% for conventional private banks and 89% from 90% for Islamic banks, till March 31, 2019.

According to banking experts, private banks would receive an influx of Tk80,000 crore due to government policies with the purpose of stabilizing liquidity.

While experts and economists criticized the government’s initiatives, saying the decisions would endanger the money of the depositors, policymakers claim there is no other way to save the banks.

A secretary of a division of the Ministry of Finance, seeking anonymity, said: “It is easy to criticize, but we have no other way to save these banks. If we had not taken the decision, these private banks would have inevitably collapsed, which would have pushed the whole banking sector into a slump and caused the country’s economy to be hamstrung.

“However, these policies are for the short term, and the banks will have to be fully revived through their own capacity,” he added.

Former Bangladesh Bank Governor Dr Atiur Rahman told the Dhaka Tribune: “Private banks are going to receive a large amount of liquidity following the implementation of government policies. These banks should have to invest money in farmers, women and SME entrepreneurs to be benefited greatly from these decisions.”

After taking these steps, Finance Minister AMA Muhith said: “Interest rates in the banking sector will fall to single digit numbers within one month.”

Former adviser to the caretaker government Dr AB Mirza Azizul Islam said the government initiatives have both positive and negative impacts.

“In one sense, the decisions would put public money at a greater risk, but there is a scope for banks to cut lending rates as their liquidity crises will be eliminated by government initiatives,” he said.

However, he asked banks to increase their deposit collection to avoid further liquidity crises.

“The central bank has to make its monitoring process stricter to prevent financial crimes in the banking sector and ensure good governance. These will help improve the situation,” added Mirza Azizul Islam.

Former chairman of the Association of Bankers, Bangladesh (ABB), and Managing Director and CEO of Mutual Trust Bank Ltd (MTB) Anis A Khan told the Dhaka Tribune: “There is no actual liquidity shortage in the banking sector. This situation is due to a distributional problem. The steps taken by the government will help us in getting out of the predicament.”

He said: “Private banks support more than 85% of the country’s businesses in terms of lending while government organizations deposit their money in state-owned banks. Until recently we were getting only 25% of their deposits.

“The government’s decision to make it mandatory to deposit 50% of the funds of state-owned agencies into private banks would make them financially healthy,” said Anis A Khan.

The MTB CEO also said: “State-owned banks support inter-bank lending to private banks. The limit for this amount needs to be raised.”

When asked what state-owned banks could do for private banks, the Managing Director of Rupali Bank Md Ataur Rahman Prodhan told the Dhaka Tribune: “We are lending enough to private banks. The decision of depositing 50% of our funds in private banks would put pressure on our funds. How can we lend anymore?”

He also said: “State-owned banks have to perform various government functions, and now we will have to be even more competitive in collecting deposits as this new policy puts pressure on our funds.”

“We are regularly investing in various government projects. We cannot lend money to private banks simultaneously,” said Prodhan.

He did, however, express the hope that the new policies would be helpful in mitigating the liquidity crisis at private banks.

Solutions beyond the governments’ steps

CEO of Mutual Trust Bank Ltd Anis A Khan said: “We have already been receiving benefits from governmental policies, but we also have to take some steps of our own.”

Bankers of private banks have to focus on reducing non-performing loans (NPLs) as well as implementing proper risk assessment during loan disbursement, he added.

Former Bangladesh Bank Governor Dr Salehuddin Ahmed told the Dhaka Tribune: “The liquidity crisis faced by private banks occurred due to the failure of the management in assessing Asset Liability Risk. Therefore, the best way to tackle the crisis was to force the banks to recover the defaulted loans.”

However, private commercial banks have to reduce their profit target, managerial and operational costs. Moreover, they need to increase deposit interest rates and practice narrow lending to prevent such kinds of crises in the future.

He also said the liquidity crisis at private banks could have been avoided if the central bank and other banking regulators had stepped up and adopted timely preventive measures.

“The regulators should find a way to recover lost money and establish good governance in the banking sector,” he added.

Former Managing Director of Social Islami Bank Limited (SIBL) Md Shafiqur Rahman told the Dhaka Tribune: “The bail-out money will initially help private banks recover from their fund shortage, which was created due to aggressive lending. However, in order to get fresh deposits, the banks have to go to rural areas in order to find depositors.

“For long-term solutions to the liquidity shortage, private banks have to adopt inclusive banking, SME banking, and rural banking,” he also said.

“Not all banks are responsible for this crisis, but the ones who are should have been held accountable by the central bank,” Shafiqur said.

“The effects of the measures taken by the government to combat the crisis will become evident after a while,” according to the Managing Director of Prime Bank Rahel Ahmed.

“There is a lagging period between the implementation of the policies and when it starts to show its outcome. We can expect the effects to become apparent in about three months,” he continued.

“This liquidity crisis is essentially an asset and liability mismatch. We have a lot of work to do regarding this, and the central bank, relative stakeholders, etc. have to help the government in mitigating the crisis,” he added.

After taking these steps, Finance Minister AMA Muhith said: “Interest rates in the banking sector will fall to single digit numbers within one month.”

Former adviser to the caretaker government Dr AB Mirza Azizul Islam said the government initiatives have both positive and negative impacts.

“In one sense, the decisions would put public money at a greater risk, but there is a scope for banks to cut lending rates as their liquidity crises will be eliminated by government initiatives,” he said.

However, he asked banks to increase their deposit collection to avoid further liquidity crises.

“The central bank has to make its monitoring process stricter to prevent financial crimes in the banking sector and ensure good governance. These will help improve the situation,” added Mirza Azizul Islam.

Former chairman of the Association of Bankers, Bangladesh (ABB), and Managing Director and CEO of Mutual Trust Bank Ltd (MTB) Anis A Khan told the Dhaka Tribune: “There is no actual liquidity shortage in the banking sector. This situation is due to a distributional problem. The steps taken by the government will help us in getting out of the predicament.”

He said: “Private banks support more than 85% of the country’s businesses in terms of lending while government organizations deposit their money in state-owned banks. Until recently we were getting only 25% of their deposits.

“The government’s decision to make it mandatory to deposit 50% of the funds of state-owned agencies into private banks would make them financially healthy,” said Anis A Khan.

The MTB CEO also said: “State-owned banks support inter-bank lending to private banks. The limit for this amount needs to be raised.”

When asked what state-owned banks could do for private banks, the Managing Director of Rupali Bank Md Ataur Rahman Prodhan told the Dhaka Tribune: “We are lending enough to private banks. The decision of depositing 50% of our funds in private banks would put pressure on our funds. How can we lend anymore?”

He also said: “State-owned banks have to perform various government functions, and now we will have to be even more competitive in collecting deposits as this new policy puts pressure on our funds.”

“We are regularly investing in various government projects. We cannot lend money to private banks simultaneously,” said Prodhan.

He did, however, express the hope that the new policies would be helpful in mitigating the liquidity crisis at private banks.

After taking these steps, Finance Minister AMA Muhith said: “Interest rates in the banking sector will fall to single digit numbers within one month.”

Former adviser to the caretaker government Dr AB Mirza Azizul Islam said the government initiatives have both positive and negative impacts.

“In one sense, the decisions would put public money at a greater risk, but there is a scope for banks to cut lending rates as their liquidity crises will be eliminated by government initiatives,” he said.

However, he asked banks to increase their deposit collection to avoid further liquidity crises.

“The central bank has to make its monitoring process stricter to prevent financial crimes in the banking sector and ensure good governance. These will help improve the situation,” added Mirza Azizul Islam.

Former chairman of the Association of Bankers, Bangladesh (ABB), and Managing Director and CEO of Mutual Trust Bank Ltd (MTB) Anis A Khan told the Dhaka Tribune: “There is no actual liquidity shortage in the banking sector. This situation is due to a distributional problem. The steps taken by the government will help us in getting out of the predicament.”

He said: “Private banks support more than 85% of the country’s businesses in terms of lending while government organizations deposit their money in state-owned banks. Until recently we were getting only 25% of their deposits.

“The government’s decision to make it mandatory to deposit 50% of the funds of state-owned agencies into private banks would make them financially healthy,” said Anis A Khan.

The MTB CEO also said: “State-owned banks support inter-bank lending to private banks. The limit for this amount needs to be raised.”

When asked what state-owned banks could do for private banks, the Managing Director of Rupali Bank Md Ataur Rahman Prodhan told the Dhaka Tribune: “We are lending enough to private banks. The decision of depositing 50% of our funds in private banks would put pressure on our funds. How can we lend anymore?”

He also said: “State-owned banks have to perform various government functions, and now we will have to be even more competitive in collecting deposits as this new policy puts pressure on our funds.”

“We are regularly investing in various government projects. We cannot lend money to private banks simultaneously,” said Prodhan.

He did, however, express the hope that the new policies would be helpful in mitigating the liquidity crisis at private banks.