The banks are Sonali, BASIC, Janata, Agrani, Rupali, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, said Bank and Financial Institutions Division Secretary Md Eunusur Rahman.

Muhith said every state bank is “now more or less weak and is facing some sort of deficit in terms of capital or provision.”

However, the new management of BASIC Bank is “doing well and has already identified who “took money out of the bank,” finance minister said.

In reply to a question, finance minister the Anti-Corruption Commission would take legal action against former BASIC Bank Board Chairman Sheikh Abdul Hye Bacchu who is accused of corruption.

“Wait and see. The ACC will take actions against former chairman of BASIC Bank.”

At present, the government has kept Tk2,000 crore in the current fiscal year’s budget for recapitalisation of the banks.

In this backdrop, finance minister held a meeting with the top officials of the banks on Sunday to discuss their capital shortfalls. They talked about the decision whether to issue bonds in their favour.

Five state-owned banks are suffering a total Tk15,000 crore capital shortfall. These shortfalls were due to corruption and mismanagement in their operations, according to the data.

These banks have sought Tk4,000 crore in the form of bonds from the government, shows an official paper sent to the finance minister. The five banks were given Tk8,000 crore cash support during FY2014-16 period to make up for capital inadequacy.

In the financial scams that took place between 2011 and 2013, three of these banks -- Sonali, Janata and BASIC -- had lost Tk12,000 crore.

Bangladesh Bank’s investigations found corrupt practices by Rupali Bank, Agrani Bank and specialised banks of the government.

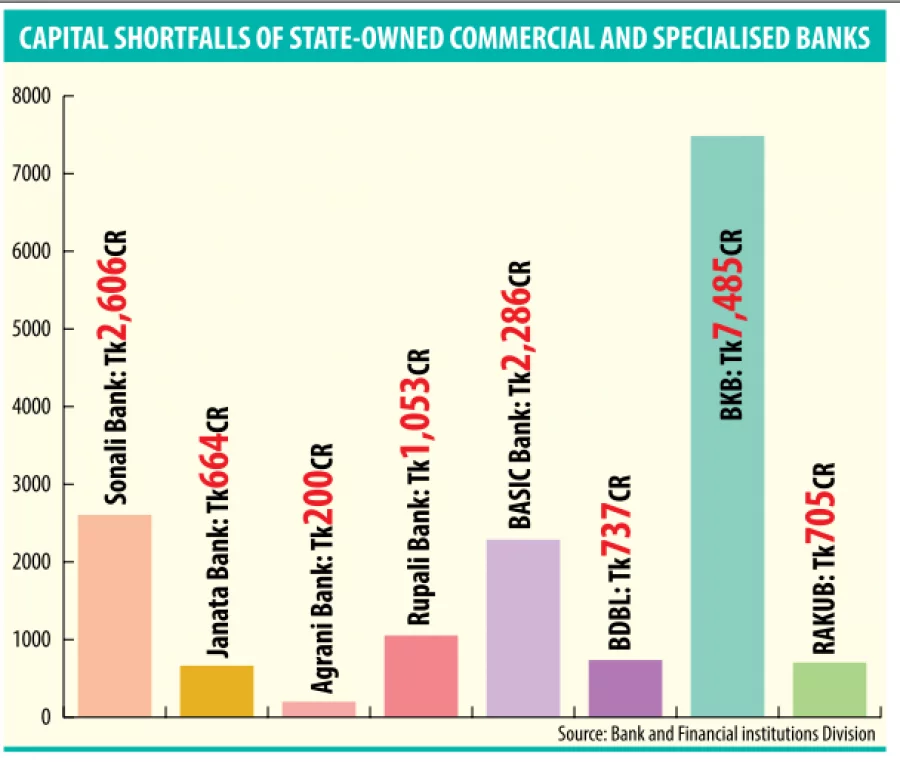

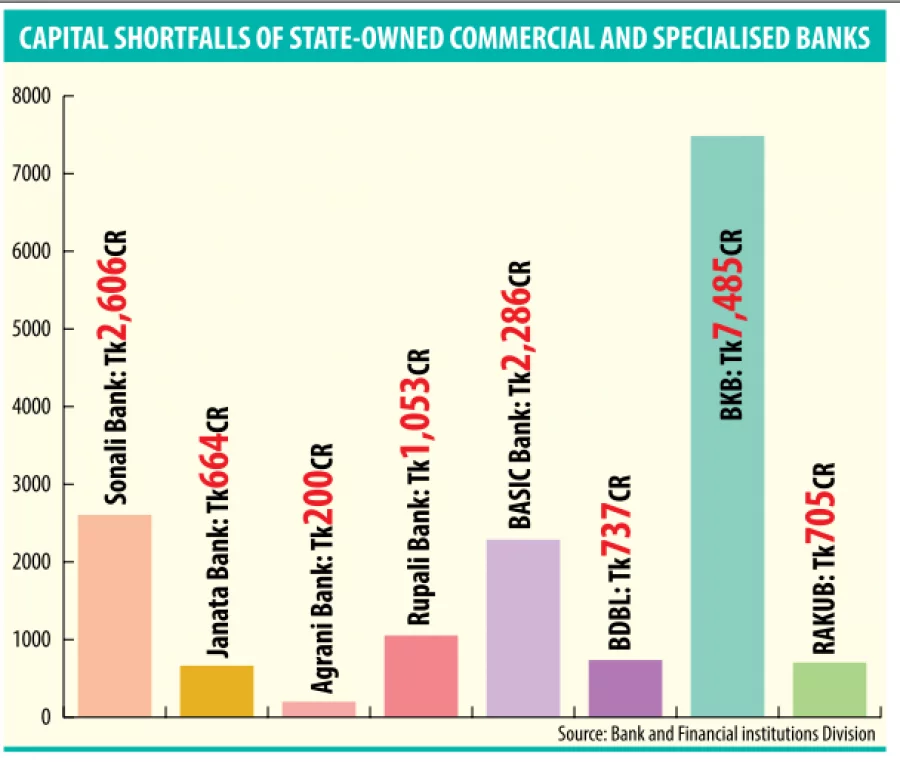

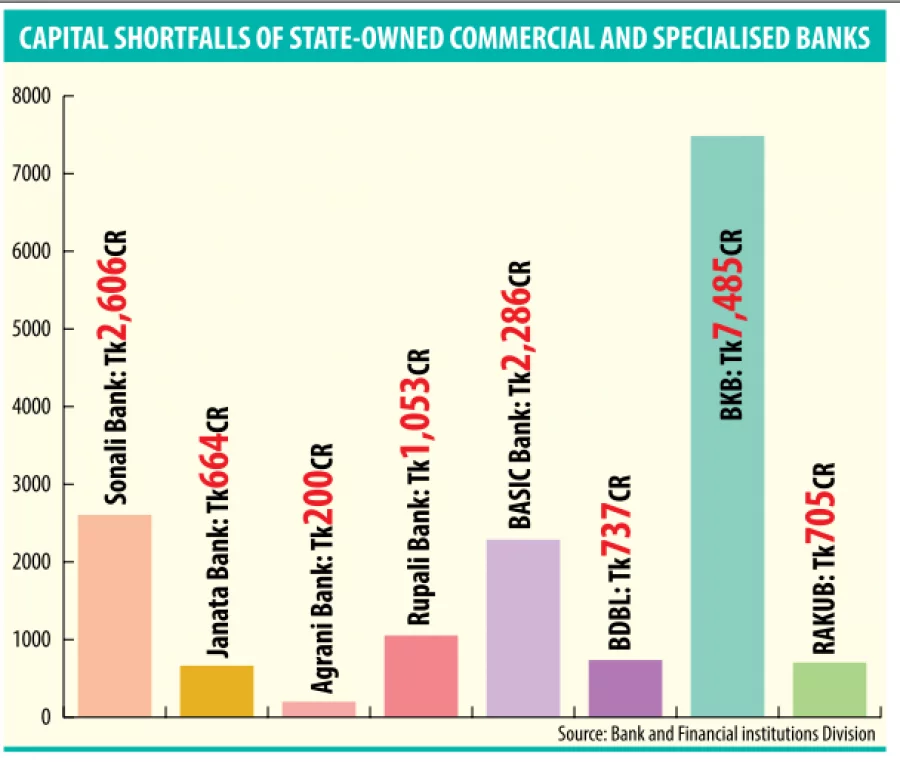

Now the capital shortfall of Sonali Bank is Tk2,606 crore, Agrani Bank Tk200 crore, Rupali Tk1,053 crore, BASIC Tk2,286 crore, Bangladesh Development Bank Tk737 crore, Bangladesh Krishi Bank Tk7,485 crore and Rajshahi Krish Unnayan Bank Tk705 crore.

The banks are Sonali, BASIC, Janata, Agrani, Rupali, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, said Bank and Financial Institutions Division Secretary Md Eunusur Rahman.

Muhith said every state bank is “now more or less weak and is facing some sort of deficit in terms of capital or provision.”

However, the new management of BASIC Bank is “doing well and has already identified who “took money out of the bank,” finance minister said.

In reply to a question, finance minister the Anti-Corruption Commission would take legal action against former BASIC Bank Board Chairman Sheikh Abdul Hye Bacchu who is accused of corruption.

“Wait and see. The ACC will take actions against former chairman of BASIC Bank.”

At present, the government has kept Tk2,000 crore in the current fiscal year’s budget for recapitalisation of the banks.

In this backdrop, finance minister held a meeting with the top officials of the banks on Sunday to discuss their capital shortfalls. They talked about the decision whether to issue bonds in their favour.

Five state-owned banks are suffering a total Tk15,000 crore capital shortfall. These shortfalls were due to corruption and mismanagement in their operations, according to the data.

These banks have sought Tk4,000 crore in the form of bonds from the government, shows an official paper sent to the finance minister. The five banks were given Tk8,000 crore cash support during FY2014-16 period to make up for capital inadequacy.

In the financial scams that took place between 2011 and 2013, three of these banks -- Sonali, Janata and BASIC -- had lost Tk12,000 crore.

Bangladesh Bank’s investigations found corrupt practices by Rupali Bank, Agrani Bank and specialised banks of the government.

Now the capital shortfall of Sonali Bank is Tk2,606 crore, Agrani Bank Tk200 crore, Rupali Tk1,053 crore, BASIC Tk2,286 crore, Bangladesh Development Bank Tk737 crore, Bangladesh Krishi Bank Tk7,485 crore and Rajshahi Krish Unnayan Bank Tk705 crore.Finance Minister AMA Muhith said the BASIC Bank, which fell into trouble after loan scams, would get “special treatment” in meeting capital shortfall.

“We are going to provide special treatment to BASIC Bank to help it come out of troubles,” finance minister told the journalists on Sunday.

“The bank needs extra nurturing as it’s condition is not normal now. It cannot be judged with others.”

The government plans to allocate Tk2,000 crore in the next budget for the seven state-owned commercial and specialised banks suffering capital shortfalls, AMA Muhith said. The banks are Sonali, BASIC, Janata, Agrani, Rupali, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, said Bank and Financial Institutions Division Secretary Md Eunusur Rahman.

Muhith said every state bank is “now more or less weak and is facing some sort of deficit in terms of capital or provision.”

However, the new management of BASIC Bank is “doing well and has already identified who “took money out of the bank,” finance minister said.

In reply to a question, finance minister the Anti-Corruption Commission would take legal action against former BASIC Bank Board Chairman Sheikh Abdul Hye Bacchu who is accused of corruption.

“Wait and see. The ACC will take actions against former chairman of BASIC Bank.”

At present, the government has kept Tk2,000 crore in the current fiscal year’s budget for recapitalisation of the banks.

In this backdrop, finance minister held a meeting with the top officials of the banks on Sunday to discuss their capital shortfalls. They talked about the decision whether to issue bonds in their favour.

Five state-owned banks are suffering a total Tk15,000 crore capital shortfall. These shortfalls were due to corruption and mismanagement in their operations, according to the data.

These banks have sought Tk4,000 crore in the form of bonds from the government, shows an official paper sent to the finance minister. The five banks were given Tk8,000 crore cash support during FY2014-16 period to make up for capital inadequacy.

In the financial scams that took place between 2011 and 2013, three of these banks -- Sonali, Janata and BASIC -- had lost Tk12,000 crore.

Bangladesh Bank’s investigations found corrupt practices by Rupali Bank, Agrani Bank and specialised banks of the government.

Now the capital shortfall of Sonali Bank is Tk2,606 crore, Agrani Bank Tk200 crore, Rupali Tk1,053 crore, BASIC Tk2,286 crore, Bangladesh Development Bank Tk737 crore, Bangladesh Krishi Bank Tk7,485 crore and Rajshahi Krish Unnayan Bank Tk705 crore.

The banks are Sonali, BASIC, Janata, Agrani, Rupali, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, said Bank and Financial Institutions Division Secretary Md Eunusur Rahman.

Muhith said every state bank is “now more or less weak and is facing some sort of deficit in terms of capital or provision.”

However, the new management of BASIC Bank is “doing well and has already identified who “took money out of the bank,” finance minister said.

In reply to a question, finance minister the Anti-Corruption Commission would take legal action against former BASIC Bank Board Chairman Sheikh Abdul Hye Bacchu who is accused of corruption.

“Wait and see. The ACC will take actions against former chairman of BASIC Bank.”

At present, the government has kept Tk2,000 crore in the current fiscal year’s budget for recapitalisation of the banks.

In this backdrop, finance minister held a meeting with the top officials of the banks on Sunday to discuss their capital shortfalls. They talked about the decision whether to issue bonds in their favour.

Five state-owned banks are suffering a total Tk15,000 crore capital shortfall. These shortfalls were due to corruption and mismanagement in their operations, according to the data.

These banks have sought Tk4,000 crore in the form of bonds from the government, shows an official paper sent to the finance minister. The five banks were given Tk8,000 crore cash support during FY2014-16 period to make up for capital inadequacy.

In the financial scams that took place between 2011 and 2013, three of these banks -- Sonali, Janata and BASIC -- had lost Tk12,000 crore.

Bangladesh Bank’s investigations found corrupt practices by Rupali Bank, Agrani Bank and specialised banks of the government.

Now the capital shortfall of Sonali Bank is Tk2,606 crore, Agrani Bank Tk200 crore, Rupali Tk1,053 crore, BASIC Tk2,286 crore, Bangladesh Development Bank Tk737 crore, Bangladesh Krishi Bank Tk7,485 crore and Rajshahi Krish Unnayan Bank Tk705 crore.

The banks are Sonali, BASIC, Janata, Agrani, Rupali, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, said Bank and Financial Institutions Division Secretary Md Eunusur Rahman.

Muhith said every state bank is “now more or less weak and is facing some sort of deficit in terms of capital or provision.”

However, the new management of BASIC Bank is “doing well and has already identified who “took money out of the bank,” finance minister said.

In reply to a question, finance minister the Anti-Corruption Commission would take legal action against former BASIC Bank Board Chairman Sheikh Abdul Hye Bacchu who is accused of corruption.

“Wait and see. The ACC will take actions against former chairman of BASIC Bank.”

At present, the government has kept Tk2,000 crore in the current fiscal year’s budget for recapitalisation of the banks.

In this backdrop, finance minister held a meeting with the top officials of the banks on Sunday to discuss their capital shortfalls. They talked about the decision whether to issue bonds in their favour.

Five state-owned banks are suffering a total Tk15,000 crore capital shortfall. These shortfalls were due to corruption and mismanagement in their operations, according to the data.

These banks have sought Tk4,000 crore in the form of bonds from the government, shows an official paper sent to the finance minister. The five banks were given Tk8,000 crore cash support during FY2014-16 period to make up for capital inadequacy.

In the financial scams that took place between 2011 and 2013, three of these banks -- Sonali, Janata and BASIC -- had lost Tk12,000 crore.

Bangladesh Bank’s investigations found corrupt practices by Rupali Bank, Agrani Bank and specialised banks of the government.

Now the capital shortfall of Sonali Bank is Tk2,606 crore, Agrani Bank Tk200 crore, Rupali Tk1,053 crore, BASIC Tk2,286 crore, Bangladesh Development Bank Tk737 crore, Bangladesh Krishi Bank Tk7,485 crore and Rajshahi Krish Unnayan Bank Tk705 crore.

The banks are Sonali, BASIC, Janata, Agrani, Rupali, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, said Bank and Financial Institutions Division Secretary Md Eunusur Rahman.

Muhith said every state bank is “now more or less weak and is facing some sort of deficit in terms of capital or provision.”

However, the new management of BASIC Bank is “doing well and has already identified who “took money out of the bank,” finance minister said.

In reply to a question, finance minister the Anti-Corruption Commission would take legal action against former BASIC Bank Board Chairman Sheikh Abdul Hye Bacchu who is accused of corruption.

“Wait and see. The ACC will take actions against former chairman of BASIC Bank.”

At present, the government has kept Tk2,000 crore in the current fiscal year’s budget for recapitalisation of the banks.

In this backdrop, finance minister held a meeting with the top officials of the banks on Sunday to discuss their capital shortfalls. They talked about the decision whether to issue bonds in their favour.

Five state-owned banks are suffering a total Tk15,000 crore capital shortfall. These shortfalls were due to corruption and mismanagement in their operations, according to the data.

These banks have sought Tk4,000 crore in the form of bonds from the government, shows an official paper sent to the finance minister. The five banks were given Tk8,000 crore cash support during FY2014-16 period to make up for capital inadequacy.

In the financial scams that took place between 2011 and 2013, three of these banks -- Sonali, Janata and BASIC -- had lost Tk12,000 crore.

Bangladesh Bank’s investigations found corrupt practices by Rupali Bank, Agrani Bank and specialised banks of the government.

Now the capital shortfall of Sonali Bank is Tk2,606 crore, Agrani Bank Tk200 crore, Rupali Tk1,053 crore, BASIC Tk2,286 crore, Bangladesh Development Bank Tk737 crore, Bangladesh Krishi Bank Tk7,485 crore and Rajshahi Krish Unnayan Bank Tk705 crore.